We believe that we have the critical experience and expertise to assist you in the front-to-back securities business flow, from matching and affirmations, data collection, through to clearing. With the implementation of t+1 settlements and the CSDR regulation creating a more complex landscape for market participants, and using a variety of mechanisms from health checks and diagnostic assessments, to industry benchmarking, we are able to help you navigate the evolving environment you operate in.

Securities

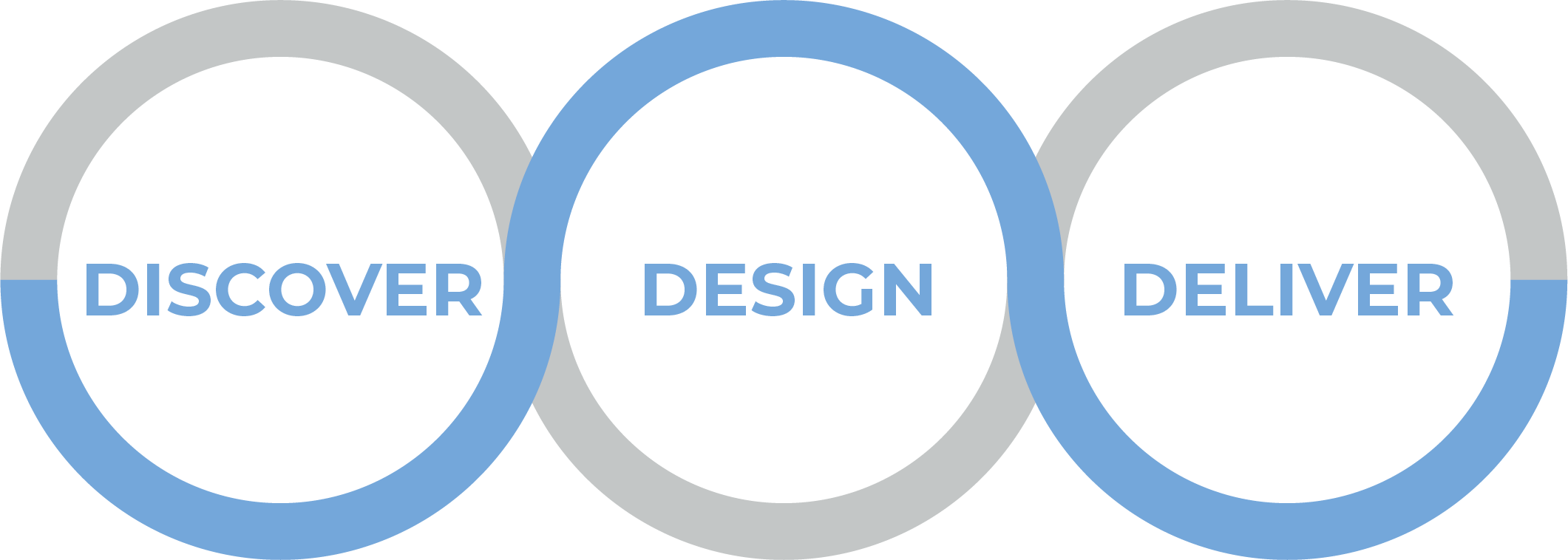

OUR CAPABILITY

OUR SERVICES

We have been actively involved in a number of market infrastructure initiatives, working with providers, users, industry associations and public bodies.

OUR WORK

IMPACTFUL SERVICES AND ENGAGEMENT MODELS

We work with clients in a variety of guises to help them meet their goals and structure our teams to be able to integrate effectively within the client environment and deliver successful outcomes.

- Current state analysis and securities health check to identify post-execution areas of improvement

- Conduct diagnostics and employ exploratory techniques to assess regulatory impact and current state readiness for upcoming regulatory changes

- Utilise Management Information (MI) to identify inefficiencies, areas of improvement and define measurable targets

- Partner with both buy and sell-side to review industry best practice, and create solutions and recommendations for trade mismatches

- Asses post-execution process in line with control frame-work

- Roadmap definition of the new operating model focussed on improving STP rates and reducing operational risk for full process optimisation

- Planning, testing and coordination of activity related to the implementation, integration or optimisation of solutions

- Quantify and measure improvements, such cost-saving, risk reduction and STP improvements, through MI

- Project Management expertise to design and govern programmes of varying complexity